Zanzibar. African nations have called for a new model of climate finance that reflects the continent’s immense natural wealth—including forests, minerals, and clean energy potential—insisting that it must translate into tangible economic benefits.

The African Group of Negotiators (AGN), meeting in Zanzibar, emphasized that Africa is a “nature-rich but cash-poor” continent that contributes less than four percent of global CO₂ emissions but provides critical ecosystem services to the planet.

“The Congo Basin, Miombo Woodlands, and mangrove forests absorb billions of tonnes of carbon,” the AGN stated. “Our resources are global assets. The world must pay its fair share.”

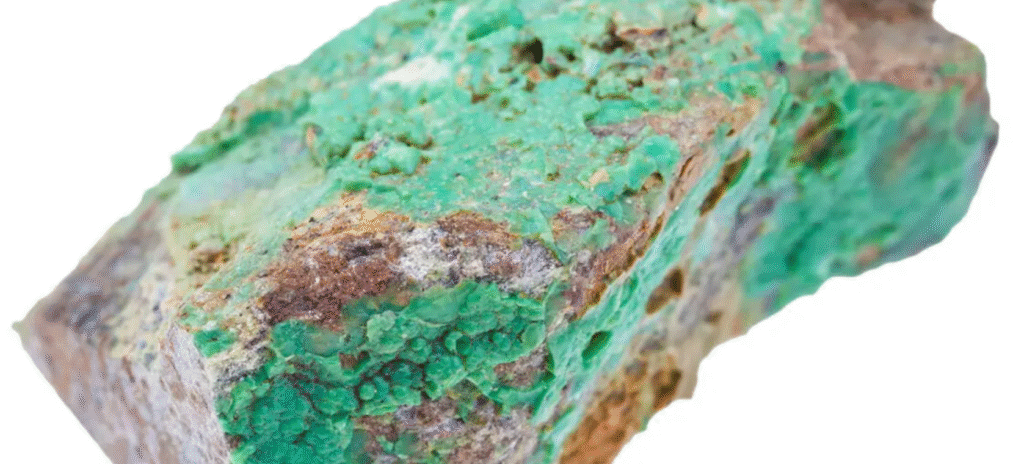

Africa also holds more than 70 percent of the world’s cobalt reserves and significant deposits of lithium, manganese, and other minerals essential for green technologies like electric vehicles and hydrogen fuel cells.

However, AGN delegates argued that without value addition and climate-smart mining practices, these resources risk being exploited without benefiting African communities. The meeting called for a continent-wide policy shift toward beneficiation and green industrialization.

To manage these assets responsibly, the AGN proposed the establishment of a financial mechanism or fund to support climate action using revenue derived from Africa’s natural capital. The AGN Chair was tasked with consulting African experts and institutions to develop a workable framework.

As COP30 approaches, this demand is expected to feature prominently in Africa’s negotiations, especially in pushing for more grants rather than debt-based finance.

Africa insists it must not bear the cost of protecting global ecosystems alone, particularly when its own people remain vulnerable to climate shocks.

I am glad to be a visitor of this unadulterated web site! , appreciate it for this rare info ! .